Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

When you’re struggling financially, every dollar counts. I’ve been there—worried about bills, frustrated with how little was left at the end of the month, and feeling like I was just surviving. The truth is, getting your money right doesn’t require a finance degree. It requires commitment, personal finance awareness, and a clear plan. Let me walk you through 23 rules that have changed my life and can change yours too.

A budget is the key to your financial success. It helps you budget where your money is going rather than questioning where it has gone. Begin by writing down all sources of income and all monthly expenses, both bills that do not change and costs that can change from one month to another, such as groceries or transport. Utilize budgeting software or apps such as Mint, YNAB, or even a basic spreadsheet to keep this.

Don’t downplay expenses—account for even the little things like your morning coffee. Look at your budget on a weekly or bi-weekly basis to keep it accurate to current spending. Realist budgets identify waste and indicate saving opportunities, in short, work as money managers. It must be adaptable but organized enough to inform decisions. Segment your expenses into categories and place a limit on each. Have a savings category to treat it as a required bill. Most notably, follow your budget—it only works if you stick with it.

Monitoring your expenses is essential to determining your spending habits. Even the littlest of expenses, such as a $2 snack or $3 latte, can translate to hundreds in the long run. Begin by logging every purchase or with an expense tracking app. Do it every day for a month to discover where your money actually goes. Most people are amazed at how much is spent on extras. Sort expenses to know what’s happening in patterns—are you overdoing dining out or subscriptions? This knowledge enables you to make deliberate reductions.

Monitoring financially also assists when doing taxes or budgeting for major purchases. It can reveal surprise leaks in your financial boat. As time goes on, you’ll automatically spend more mindfully. Use every dollar like a soldier—know where each dollar is headed and if it’s serving a purpose towards your objectives.

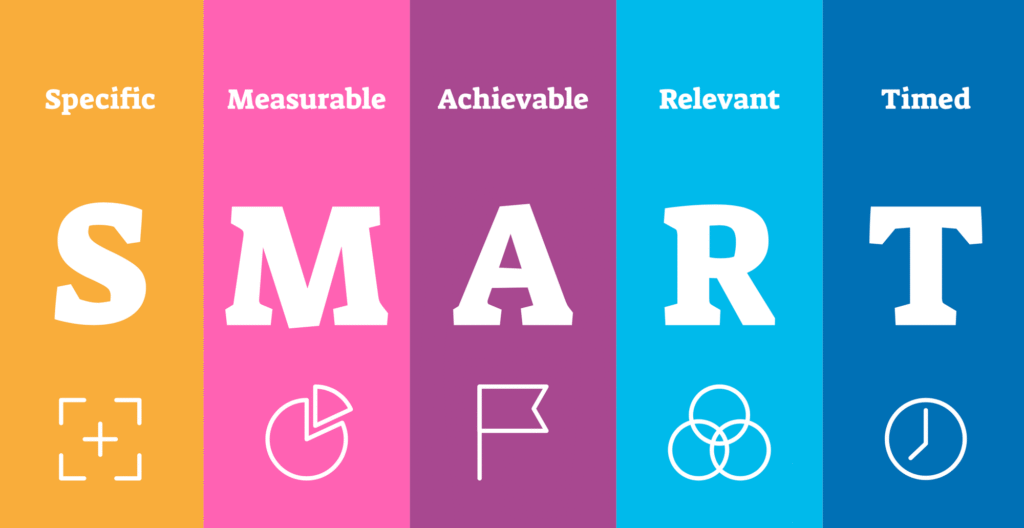

Having SMART goals provides you with direction and intention in handling money. SMART means Specific, Measurable, Achievable, Relevant, and Time-bound. Rather than “I want to save money,” use “I will have saved $1,000 in three months in an emergency fund by saving $84 a week.” This format compels clarity and commitment, financially. Divide major objectives into small steps to prevent feeling swamped. Monitoring progress is simpler when the goal is quantifiable. Make sure that the goal is realistic according to your earnings and existing commitments.

Relevance keeps you engaged—attach goals to personal aspirations such as traveling, home ownership, or debt freedom. A deadline gives it some gravitas and avoids procrastination. SMART goals assist in weeding out unclear intentions and substituting those with doable actions. Keep the goals in front of you—on the fridge, phone, or notepad—to remind you every day.

A precautionary fund is your security blanket financially. It insures you against unforeseen situations such as the loss of a job, medical expenses, or a car breakdown. Without it, a lot of individuals fall back on high-cost credit cards or loans when a crisis strikes. Try to save between 3 to 6 months of basic expenses such as rent, groceries, utilities, and insurance. Begin modestly—saving just $500 can soften small emergencies. Keep this money in a special, easily accessible savings account, not commingled with money for everyday expenses.

Don’t tap into it except in the case of a genuine emergency. This buffer lowers personal finance stress and stops debt cycles. It provides you with the courage to take radical actions such as changing your career or pursuing a side business. Save consistently, even if it’s small, until it’s at your desired level. Once established, review it yearly and adjust it based on changing expenses.

Saving for retirement early gives you the advantage of compound interest. A Principal 401k is an employer-sponsored retirement plan, often with matching contributions. This means if you invest 5%, your employer might add another 5%, essentially giving you free money. Contribute at least sufficient to receive the full match—don’t leave money on the table. The sooner you begin, the more your money will grow. For instance, contributing $200/month during your 20s may pay more than beginning with $500/month in your 40s.

Contributions are usually made pre-tax, reducing your taxable income today. Select diversified investments within the principal 401k plan to keep risk under control. Review your portfolio every year and contribute more when you receive raises. Don’t take withdrawals early, as that gets charged penalties and taxes. Make your principal 401k a keystone of your long-term personal finance security.

High-interest debt, such as credit card debt or payday loans, can wipe out your financial progress. They are typically more than 20% interest, so your balance accelerates quickly if not paid. Pay off the most expensive interest debt first with the avalanche method and keep the minimum payments on the others. This is cheapest in the long term. Write down all your debts, track the interest rates, and develop a plan to pay them back.

If this is too much, consolidate debts or try to negotiate for lower interest rates. Refrain from piling more debt on top—destroy your cards if you must. Each additional dollar you can direct at this debt will accelerate your path to freedom. When the high-interest debt is eliminated, apply those payments to savings or investments. It’s not merely a matter of numbers; eliminating debt ends financially mental and emotional stress. Mark milestones to remain encouraged and monitor your progress visually.

Automating your finances guarantees steadiness and prevents the possibility of late payments or lost savings opportunities. Automate transfers to your savings or investment accounts immediately after payday, paying savings like an indispensable bill. Automate regular bills such as rent, utilities, and credit card bills too. This minimizes the risk of human mistakes and time wastage. It also ensures that you remain within your budget since you do not “feel” the money you save. Utilize bank features or budgeting apps to streamline automation.

For expenses that vary, set reminders or delayed auto-payments. With time, money managers’ automation develops discipline without needing daily choices. You will be amazed at how much you save without even realizing it. This method also enhances your credit score by preventing missed payments. It’s a “set it and forget it” personal finance approach that builds long-term habits.

Personal finance clarity starts with distinguishing between needs and wants. Needs are essentials—housing, food, transportation, healthcare—things necessary for survival. Wants are extras—streaming subscriptions, takeout, gadgets, or luxury items. When money is tight or you’re pursuing a goal, prioritize needs. Make a list of your monthly expenses and mark which are true necessities. Many people confuse convenience with need, like daily coffee shop visits or meal delivery.

Train yourself to pause before a purchase and ask, “Do I need this to live or work? ” This mindset shift helps reduce impulse spending. Wants aren’t bad, but they should be budgeted for intentionally, not indulged impulsively. Balance is key—budget a percentage for fun after handling essentials.

Knowing this distinction creates lasting wealth and promotes financially conscious consumption.

If you are struggling financially, I would advise to adopt this rule, and that rough rule of thumb is to save 20% of your net income monthly. This may sound excessive, but it creates a solid financial safety net over time. Divide this 20% among short-term savings, long-term investments, and emergency funds. Start small if necessary—10% is better than nothing—and build up gradually. Use automation to transfer this money before you have an opportunity to spend it. Monitor progress every month to keep yourself motivated. When you receive bonuses or tax refunds, set aside a portion of those as well.

This discipline helps you be ready for life transitions such as relocating, having children, or retirement. Early retirees and investors in passion ventures are typical of high savers. Regular saving creates options, freedom, and the peace of mind that comes with them.

Save first, just as you would pay bills or rent—it’s your future self’s paycheck.

This rule of gold is straightforward but willfully disobeyed. Spending more than earning money means debt, stress, and struggling financially. It is so easy to fall into this with credit cards or buy-now-pay-later offers. Avoid it by monitoring your monthly income and allocating spending within it. Resist lifestyle inflation—just because you make more doesn’t mean you have to spend more. Practice deferred gratification by waiting to buy large items. Distinguish needs from wants to rein in unnecessary spending. When expenses outweigh income, look for ways to reduce or raise revenue.

Inspect your budget each month to maintain discipline. Living below your means provides room for saving, investing, and financial independence. It’s the number one most powerful habit for long-term wealth-building.

The sooner you invest, the longer your money has to grow as a result of compound interest. Compound interest is when you earn interest not only on your original investment but also on the interest it gains over time. For instance, if you have $1,000 invested at a 7% return each year, in 30 years it will become more than $7,600—without you adding a dime. The secret is time. Small amounts can add up to big bucks if allowed to compound over time. Begin by putting money into a retirement account such as an IRA or Principal 401k, or an index fund with low fees.

Don’t wait to “have more money” and begin investing, starting with even $50 monthly is better than nothing. Invest regularly and raise contributions when you are able. Dollar-cost averaging will help minimize risk over time. Early investing generates passive income, financial freedom, and a pleasant retirement. Waiting to invest is among the greatest financial regrets people have in their later years.

Maintaining a good credit score opens personal finance doors—it impacts loan approvals, rates of interest rates, renting houses, and even getting a job. Your score is determined by payment history, utilization of credit, length of credit history, type of credit, and recent inquiries. Pay your bills on time—this accounts for the most. Keep credit card balances low, below 30% of the limit, to demonstrate responsible use. Don’t close old accounts, which contribute to credit history length.

Check your credit report every year for errors through free sources such as AnnualCreditReport.com. Challenge any errors right away. Don’t apply for several credit lines over a short period. An excellent score (usually over 700) earns you a lower interest rate, saving you thousands. Your credit score is your money manager’s skill reputation—treat it like your identity.

Your budget is a living document that must change along with your personal finance. Check it each month to find out what’s going right and what’s going wrong. Did you spend more in one area? Did a surprise bill derail your plan? These are hints to tweak the numbers, not quit. Life is ever-changing—expenses, income, and priorities shift. Perhaps you received a raise, or your rent went up, or you’re saving for vacation. Reflect those shifts in your budget to remain in command.

Reviewing also causes you to identify wasteful subscriptions or find savings opportunities. Save receipts or use tracking software to contrast budgeted vs actual spending. Progress, not perfection, is the intention. Regular monthly reviews increase awareness, accountability, and discipline in your spending.

Lifestyle inflation occurs when expenditures rise as earnings rise. Rather than saving the additional income, people tend to upgrade vehicles, eating out, wardrobes, or take vacations. This can get you into a paycheck-to-paycheck way of life even when you make more money. To stop this, plan ahead of time what portion of any increase will be put into savings or going toward debt as we have discussed earlier.

For instance, pledge to save 50% of each raise. Treat yourself to a little something, but avoid spending a lot of money based on short-term increases. Keep living below your means and try to keep your original lifestyle as much as you can. Divert excess money into investments, retirement, or savings. Wealth is not developed by what you make, but by what you save. Forgone pleasure today will give you freedom and options tomorrow. Prioritize future peace over temporary indulgence. And this is one of the way you can get rid of struggling financially.

Personal finance discipline often comes down to the ability to say “no.” This includes saying no to friends, social events, retail temptations, and even family expectations at times. It’s okay to skip an expensive night out if it means staying on track with your goals. Peer pressure can lead to overspending, especially in the age of social media, where everyone shares highlights.

Politely decline and suggest budget-friendly alternatives instead. You don’t owe anyone an explanation of your financially constructive choices. Practice self-discipline by separating emotional desires from real necessities. Saying no today equals saying yes to something better down the road, such as a house, education, or living debt-free. Be strong in setting your limits and adhering to your financial principles. Each dollar saved on a nonessential is a dollar that can be working for your future.

High-interest debt, including credit card debt, can really suck your money dry. The interest rates charged on them may be anywhere from 15% to more than 25%, and it becomes difficult to pay the principal if you’re only making minimum payments. Pay more than the minimum and put extra money toward the highest-interest debts first, as i have discussed—this is referred to as the avalanche method. Or, you can do a snowball, paying off the smallest debts first to create momentum.

Whatever you do, be consistent. You might want to roll your debt over into a lower-interest loan if it makes paying out easier. Don’t take on additional debt when attempting to pay down existing balances. Each dollar you spend in interest is money that’s not contributing to your future. Being debt-free provides peace of mind, improves your credit score, and frees up cash for saving and investing. Make debt payoff a top priority—it’s one of the best guaranteed returns on your money. Imagine how empowering it will feel when your income belongs entirely to you, not your creditors.

Impulse shopping is probably the greatest danger to personal finance. That instant desire to purchase something new—online or in the store—can sabotage your budget. To avoid this, apply the 24-hour rule: wait one full day before purchasing any product. This break allows you to sit back and reflect logically on whether you really need it. Many times, the craving subsides, and you realize you didn’t really desire it in the first place.

For pricier goods, take the longer wait time of 72 hours or even a week. While you wait, read up on the item, shop around, and read reviews. This not only saves you money but also results in better buying decisions. Keep a wishlist instead of a cart to manage your desires thoughtfully. Over time, you’ll develop greater self-control and spend more on what truly adds value.

Impulse control is a cornerstone of building long-term wealth.

Relying on a single income source might be dangerous in the uncertain economy of today. Being unemployed, falling ill, or experiencing economic difficulties might expose you to vulnerability when you lack an alternative. Having multiple sources of income brings in financial stability and invites quicker wealth accumulation. Begin a side business, freelance, rent out a car or room, or invest in dividend-paying stocks. Even a small amount of passive earnings can add up significantly over a long period.

Diversification of income also brings about new skills, makes you resilient, and offers flexibility. Consider your income a table—having more legs stabilizes it. Don’t wait until there is a money emergency before you find alternatives. Diversified income can enable you to pay off debts sooner, save more, or retire earlier.

Stability comes not from how much you earn, but from how many ways you can earn it.

Insurance is a key part of financial planning as it protects you and your loved ones from unexpected, perhaps devastating, expenses. Health insurance pays for medical bills that could otherwise drain your savings. Disability insurance replaces some of your income if you’re disabled and unable to work. Life insurance leaves financial security for your dependents if you die. Homeowners or renters insurance protects your property from damage or theft.

Auto insurance covers accidents and liability. Evaluate your insurance needs based on your life situation—single, married, with children, own a home, etc. Choose policies with adequate coverage limits and reasonable premiums. Avoid skipping insurance to save money—doing so can be a costly gamble. Check your insurance policies every year to change coverage as your requirements change. Insurance is a good night’s sleep; it prevents one disaster from becoming a financial one. Just relax and let money managers do their job.

Understanding how taxes impact your personal finance and investments keeps you holding onto more of what you earn. Different sources of income—salary, dividends, capital gains—are taxed differently, so it’s a good idea to understand the rates so that you can plan ahead. Use tax-advantaged vehicles like IRAs, principal 401k, or HSAs to push or avoid taxes legally. Keep impeccable records of deductible expenses like charitable contributions, mortgage payments, or business expenses to reduce taxable income. Maximize your filings using a tax professional or software.

Tax planning is not just for April—it should be a year-round plan. Make use of “bunching” income or deductions into lower-tax years. For investors, think about being mindful of capital gains tax when selling assets. Smart tax planning minimizes your effective income and leaves you with more cash to invest. The trick is to pay what you must pay—not one dollar more, not a dollar less—and still achieve your financial goals.

Financial literacy is a continuous process that allows you to make better decisions and avoid costly mistakes. Markets, laws, technologies, and products evolve every day, so it’s worth getting current. Read books, listen to podcasts, subscribe to responsible personal finance blogs, or work through workshops. Learning about budgeting, investing, debt management, and tax planning gives you the most choices. You need to get a handle on your financial reports and follow the trail of your money.

Break through common myths and misconceptions about money that may hold you back. The more you know, the more you’ll be confident in making choices aligned with your goals. Sharing what you know with others reinforces your knowledge. Money literacy is not just about numbers—it’s about attitude and habits. A vow to educate yourself on money harvests dividends along the way by causing you to build wealth and avoid pitfalls.

“Financial planning is an ongoing process, not a one-off exercise.“

Circumstances change—income changes, family grows, priorities adjust, or the economy shifts. Make provision for a periodic review of your financial plan at least half-yearly. Use these appraisals to assess your investment holdings, savings momentum, debt levels, and budget. Check if your goals are still relevant and realizable. Adjust contributions, spending, or investment composition, as needed. Significant life events or windfalls should also trigger a review.

For example, a raise can help you increase retirement savings. Likewise, market downturns can force you to rebalance investments. Meeting with a financial advisor amid important changes can provide professional advice. Staying engaged in your financial plan keeps you on course and enables you to adjust early on rather than in reaction. It’s your blueprint, and i just want to say that keep it up to date for the most streamlined journey.

Building wealth and achieving financial goals is rarely speedy; patience and self-discipline are required.

Market ups and downs, unexpected expenses, or slow progress can be discouraging, but persistence pays off. Avoid impulsive financial decisions driven by emotions like fear or greed. Stick to your budget, savings plans, and investment strategies even when results aren’t immediate. Celebrate small milestones to stay motivated, but don’t get complacent.

Understand that compounding growth takes time—overnight success stories are rare. Developing habits such as systemized savings and regular money checks builds discipline. Delay gratification by prioritizing long-term benefits over short-term pleasure. Surround yourself with such individuals who are inspiring you toward your objective. Remind yourself of the reason you started in the first place—perhaps financial freedom, security, or supporting loved ones. Disciplined behavior over time totals significant sums of financial security and achievement.

1. What is the best way to start saving money?

The best way to save money is to create a realistic budget that clearly outlines your income and expenditure. Begin by setting aside a small amount each month and have your savings automatically happen without your explicit knowledge. Your first goal should be to create an emergency fund equal to 3 to 6 months of your essential expenses. Over time, as your income increases, increase your savings proportion.

2. How much do I need to save for an emergency fund?

Financial advisors recommend that you save 3 to 6 months of your basic living expenses in an emergency fund. This fund will cover rent or mortgage, utilities, food, transportation, and insurance. The amount depends on your individual situation, job stability, and monthly outgoings. Having such a buffer ensures that you will not have to borrow money when you experience unexpected financial hardship.

3. How can I improve my credit score quickly?

To increase your credit score quickly, pay bills on time, reduce your credit card balances to below 30% of your credit lines, avoid opening new lines of credit unnecessarily, and dispute errors on your credit report. Keeping older accounts open and a balance of credit types can also help you out. In addition, check your credit report periodically to observe your improvement and catch inaccuracies.

4. Should I save or pay off debt first?

Overall, it’s better to set up a small emergency fund initially (around $500-$1,000) before paying off high-interest debt and credit card balances aggressively and then other high-interest debt. Once you’ve set up a bare minimum safety net, focus on paying off high-interest debt as quickly as possible since it can turn out to cost more in the long term. After you’ve paid off debt, save and invest for long-term goals.

5. How much of my budget do I need to save?

A common guideline is to save 20% of your income. The 20% is split among emergency savings, retirement savings, and other savings objectives. The 50/30/20 rule suggests 50% for necessities, 30% for discretionary spending, and 20% for debt reduction and savings. Split percentages based on your personal objectives and expenditures.

6. How much should I save in my 401(k)?

It’s a good idea to contribute at least sufficient funds to your 401(k) to receive the full employer match, if available, since this is free money. Ideally, contribute 10-15% of your income towards retirement in the long run. Gradually increasing contributions, particularly following increases, maximizes your savings and the compounding effect.

7. What are some efficient methods of lowering monthly costs?

Good ways to save money are canceling unnecessary subscriptions, having meals at home instead of dining out, haggling over bills like cable and insurance, shopping with a list in order to avoid impulse buying, using cashback or coupons, and reducing utility use. Exploring your budget every now and then helps you identify areas where you can save even more.

8. How do I start investing with limited funds?

You can get started with minimal funds through apps that allow fractional shares or micro-investing, like Robinhood, Acorns, or Stash. Invest in low-expense index funds or ETFs to minimize risk diversification. Small regular investments automatized over time can pay off. Educate yourself about fundamental investing and avoid high-risk speculative investments in the early stages.

9. What is a 401(k) versus an IRA?

A 401(k) is an employer-sponsored retirement plan typically with employer matching, and higher contribution ceilings. An IRA (Individual Retirement Account) is an individual retirement account you set up yourself, with more investment choices but less contribution ceiling. Both are tax-advantaged but differ in withdrawal requirements and qualifications.

10. How do I avoid lifestyle inflation?

Avoid lifestyle inflation by keeping your spending habits even as your income increases. Invest or save extra income instead of enjoying the high life immediately. Set financial objectives and track spending in the long run in order to stay disciplined. Delaying luxury items and living below your desires instead of below your means facilitates long-term wealth accumulation.

Share your details, and we will get back to you shortly!

This will close in 0 seconds

Share your details, and we will get back to you shortly!

This will close in 0 seconds