Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Saving money has always seemed like a complicated, daunting endeavor—at least it did to me. I’d glance at my bank statement at the end of each month and wonder where all of my hard work money went. I wasn’t irresponsible with cash, but I also wasn’t responsible with it. Then, I learned the secret of a saving money challenge—and trust me, it totally revolutionized the way I manage my finances.

In this blog post, I’d like to share my own experience, lessons, and advice that enabled me to finally get a handle on my finances. If you’ve ever been curious about how to save money and been frustrated at failed attempts at budgeting, and other budgeting tips are not working for you, keep reading. You’re not alone—and there’s a better way to do this.

When I initially took on a money challenge, I erred by telling myself, “I just want to save more.” That didn’t get results. Why? Because having vague goals doesn’t motivate action. I instead sat down and I scribbled out a specific, measurable goal: I wanted to save ₨50,000 in 3 months for an emergency fund.

Having this clear goal kept me on task and motivated. Whatever you’re saving for, a vacation, a rainy day, or a large purchase, assign a number and an end date to it. It makes it concrete and measurable, and provides something tangible to celebrate when you achieve it.

After I set my savings target, I needed a plan. Budgeting advice came in handy. I prepared a budget that listed everything in my income and expenses. I classified my expenses (bills, food, entertainment, etc.) and set aside a share for savings.

But here’s the secret: I ensured that my budget was realistic. I did not attempt to cut out everything at once. I gradually cut down on expenses and put that money into savings. I also checked my budget on a weekly basis, making revisions when necessary.

And yes, I employed a tool for this purpose. I’ll discuss more about that later.

Here’s something I didn’t know until I began my savings odyssey: I was hemorrhaging money in ways I didn’t even realize. A coffee here, an impulsive online buy there—it added up quick. So I began to document every single spending.

You can utilize an app, a spreadsheet, or even a tiny notebook. The key is to become super-aware of where you spend money. Monitoring assisted me in realizing where I spent money on impulse, and where I could reduce spending without feeling deprived.

Let’s talk about cutting unnecessary expenses. At first, it sounded like torture. I thought I’d have to give up everything fun. But that’s not what it’s about.

I came to understand that I didn’t need to give up on living—I just needed to be more purposeful. I canceled my unused streaming subscriptions, began meal prepping rather than dining out, and mastered saying “no” to things that were not aligned with my objectives. To my surprise, I didn’t miss out much.

It’s not deprivation—it’s prioritizing.

Saving money isn’t merely a matter of what you give up—it’s also a matter of what you do. I discovered subtle but impactful ways to save:

This made me understand that you don’t need to make more in order to save more—you just need to be more clever with what you do have.

One of the best things I did throughout my saving money challenge was automate my savings. I had an automatic transfer from my primary account to a different savings account immediately after payday.

Why does this work so perfectly? Because it takes willpower out of the picture. You don’t see the money, and thus you don’t spend it. It’s like paying yourself first—and that’s precisely what saving is.

Automation is a game changer if you are serious about saving money on a consistent basis.

A savings journey can seem long, and sometimes dull—unless you make it interesting. That’s why I began rewarding myself for achieving small milestones.

For instance, when I achieved my first ₨10,000, I splurged on a nice dinner (of course, within budget). When I reached ₨30,000, I spent the weekend in a nearby Gaming Arcade. These small celebrations kept me enthusiastic and motivated.

You have earned to rejoice at the endeavor. Because, after all, this is not merely about money—it’s about improvement, self-discipline, and creating a better tomorrow.

I did not anticipate that a straightforward challenge would have such an impact. It wasn’t merely about reaching a savings figure—it was about transforming my attitude. I grew more aware, more disciplined, and more self-assured in my money matters.

If you have never done a saving money challenge, I encourage you to do so. Pick a time period—30 days, 60 days, 90 days—and challenge yourself to save an amount of money. Make it entertaining. Perhaps even get a friend or partner to do it with you. You will be amazed at what you can do.

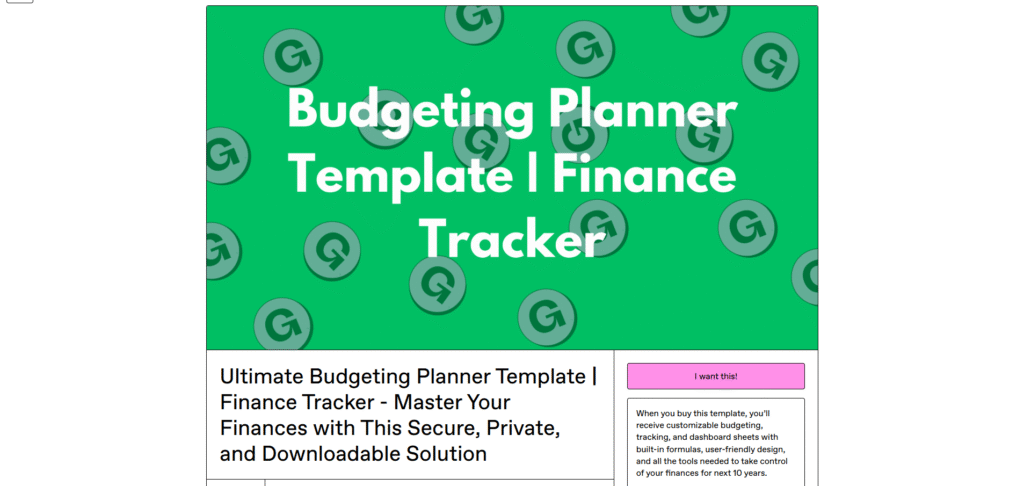

During my travels, the one thing that helped the most was the Ultimate Budgeting Planner Template | Finance Tracker that I made myself. It’s a downloadable Excel-based budgeting template that functions completely offline—ideal for us who are concerned about keeping things private and do not want to use internet-based tools.

This planner enabled me to create customized budget categories, monitor income and spending in real time, and chart my financial trends with easy-to-understand dashboards. It enabled me to review, tweak, and maintain my plan, whether I was budgeting for groceries, rent, or savings objectives. It’s particularly well-suited for individuals, families, freelancers, or even small businesses wanting to get a handle on their finances with simplicity and transparency.

If you’re committed to getting your money back in control, this template is a necessity.

Saving money is not a single occurrence—it’s a routine, a lifestyle, and a skill that grows over time. The more you do it, the simpler it becomes. And the more progress you achieve, the more inspired you’ll be to continue.

I began with a single, simple savings challenge and ended up totally rewiring my relationship with money. You can do it too. You don’t have to be perfect, just consistent. Make a goal, stick to a budget, monitor your spending, automate where you can, and always keep why you’re doing this in mind.

Your future self will thank you.

Share your details, and we will get back to you shortly!

This will close in 0 seconds

Share your details, and we will get back to you shortly!

This will close in 0 seconds